Woohoo! You just received your first salary. It is hard to contain your excitement. But wait…what? Why is it so less? Hadn’t you discussed a 5L per annum package? 5,00,000 divided by 12 is 41,666, but you’ve just got somewhere around 34,000 in your account. Where did the rest go?

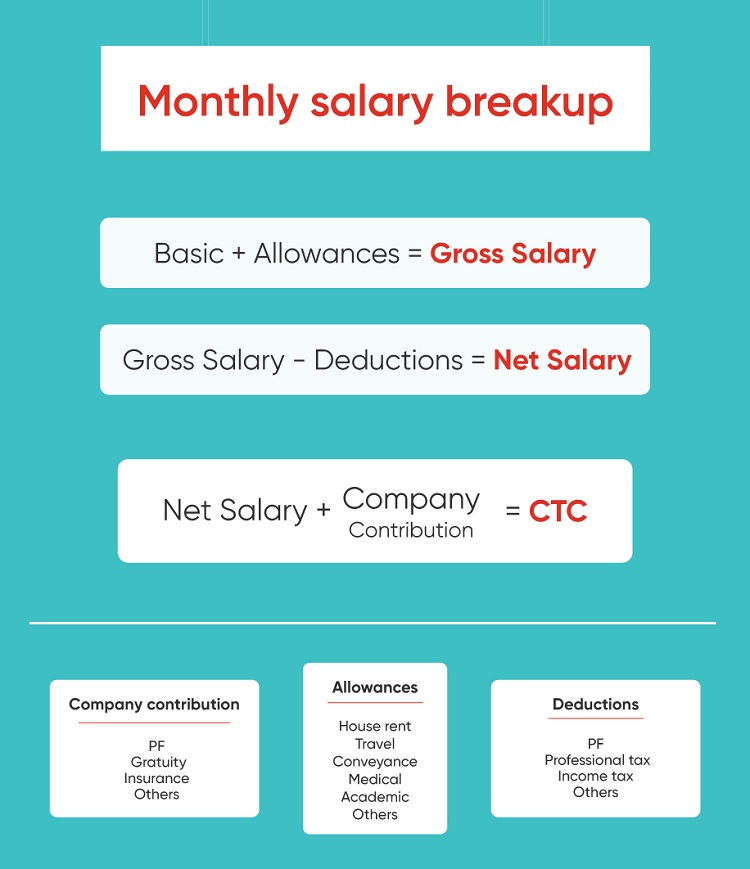

We’ve all had that confusion while kickstarting our careers. The terms like basic salary, gross salary, net salary, PF, PPF, gratuity, etc. can get confusing and sometimes, overwhelming. But, don’t you worry! Here’s a simple salary breakup that will help you understand your salary structure.

Understanding your salary breakup:

CTC:

Cost To Company is the total amount of money the company spends on you. This includes basic pay, allowances, reimbursements, etc. This is what the company offers you during the process of hiring you. Do not assume that you’ll get the full amount because there will be other deductions and the take-home salary is going to be different from the CTC.

Basic salary:

This is the main component of your salary structure. This will define the amount of all the other components such as PF, gratuity, etc. This amount depends on the industry you are working in and also your designation.

Gross salary:

Gross salary is the sum of the basic salary and allowances. This amount is calculated before the deductions.

Net salary:

This is your take-home salary. To calculate your net salary, add your basic salary and allowances. Deduct income tax, EPF and professional tax. That’s the amount that will be credited to your account every month. Now, you can have a realistic expectation of your income.

Allowances:

This is the amount that the company gives you for various things like house rent, leave travel, conveyance, medical, etc. This amount will differ from company to company.

Provident fund:

This is an investment that you and your company, both make each month for your retirement. This amount works as your retirement benefits scheme. This will be 12% of your basic salary. If your salary is more than Rs.15,000 per month, the company may choose to contribute 12% of Rs.15,000 and not on your actual basic salary.

Gratuity:

This is the part of your salary that is given to you by your employer when you quit. You’ll receive this amount only after you complete 5 years of service with the company. This money will be deducted from your salary every month.

Life insurance and health insurance:

A small amount of money will be deducted every month for your salary towards your health insurance and life insurance. Many companies provide these insurances to their employees and the premium will be paid by you.

Income Tax:

The tax amount you have to pay on a monthly basis on your taxable income will be deducted before you get your salary in hand. This is called TDS (Tax Deducted at Source). The amount that is deducted from your salary is paid to the government. The amount depends on your income and what tax slab you fall into.

Professional tax:

A few of you might have something called a professional tax as a part of your salary structure. This amount is charged by the state government to practice a certain profession. This tax is to be payable only in certain states and union territories.

Nice guide. I got all the points about how the salary system works. Thanks!

I recently had the good fortune of reading your article. It was well-written and contained sound, practical advice. In fact, I have already benefited from your discussion on risk versus return.

Great Article. Its really informative and keep posting with latest updates. Thanks for sharing.